Every so often a service provider would get in contact with us who would explicitly ask for a set-up with Verified by Visa and MasterCard SecureCode, which is called 3-D Safe service provider account. Typically they might try this, even when a non 3-D service was accessible for her enterprise. More often than not, these are worldwide retailers doing enterprise in some excessive threat trade or different, who’ve beforehand used each kinds of service provider accounts and have had lower than passable expertise with the non-3-D model. The largest failure they cite, as ever, is that the non-3-D sort had failed to guard them from chargebacks that weren’t their fault. 3-D options, in distinction, had helped them maintain chargebacks low and their service provider accounts in good standing.

So, if a 3-D Safe service provider account is best at minimizing chargebacks, why would a service provider wish to use the rest? Certainly, why is 3-D Safe sort the exception (at the least within the U.S.), reasonably than the norm? Nicely, the largest motive is that the 3-D protocol makes the check-out course of rather more convoluted and cumbersome than it in any other case is, because it requires clients to undergo an extra process to confirm that they’re licensed customers of their bank cards.

And this process will not be so simple as getting into a card’s safety code or your ZIP code, but it surely includes registering the cardboard with Visa or MasterCard and creating yet one more person title and password within the course of. Many cardholders are understandably unwilling to go the additional mile and the top result’s {that a} 3-D resolution could trigger a service provider to lose as much as 30 p.c of her transaction quantity. Sure, it that large of a distinction!

So what sort of a service provider account do you have to select for your enterprise? The reply is “it relies upon”. Most of you’ll be higher served by a standard, non-3-D, service provider account. If, then again, you do have a very large downside with fraud-related chargebacks, you’ll almost definitely profit from a 3-D resolution. In any other case, it’s possible you’ll effectively have your service provider account shut down. Should you occur to go for a 3-D Safe, here’s what you might want to learn about Verified by Visa. I’ll cowl MasterCard SecureCode individually, for the sake of readability.

Verified by Visa Fundamentals

Verified by Visa is predicated on what is called 3-D Safe — an XML-based protocol, which was developed by Visa. Actually, Visa named it Verified by Visa. The brand new protocol had the target of bettering the safety of on-line funds. Different main card manufacturers later adopted the protocol and designed their very own 3-D options. MasterCard’s is known as MasterCard SecureCode, JCB’s is named J / Safe and American Categorical’ — American Categorical SafeKey.

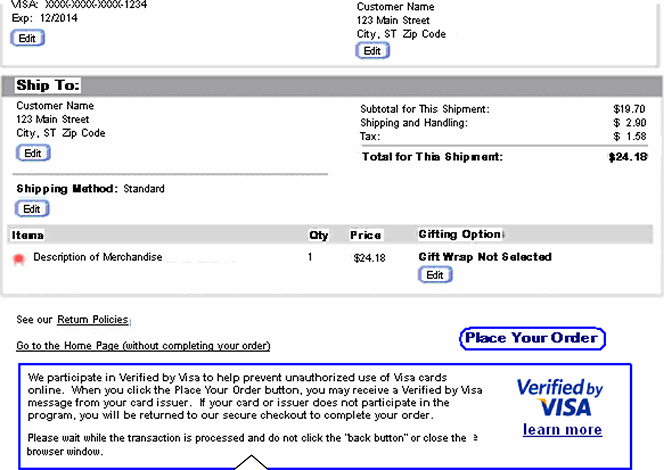

These companies authenticate cardholders’ identification throughout a web-based transaction at 3-D taking part retailers. At checkout, the retailers would present a quick message to the shopper to inform her that she would possibly subsequent be prompted both to activate her card with the related 3-D service or, if the account is already activated, to offer her password. Right here is how taht message would possibly look:

The pre-authentication message might be integrated into the checkout web page, as proven under:

If the cardholder ought to must activate her Verified by Visa account, she can be prompted to enter her card quantity and e mail deal with. Then the cardholder can be requested to confirm her identification by offering her title and card safety info.

As soon as authenticated, the cardholder is prompted to create her Verified by Visa account, which might contain issues like choosing secret questions and responses, private greetings and a password.

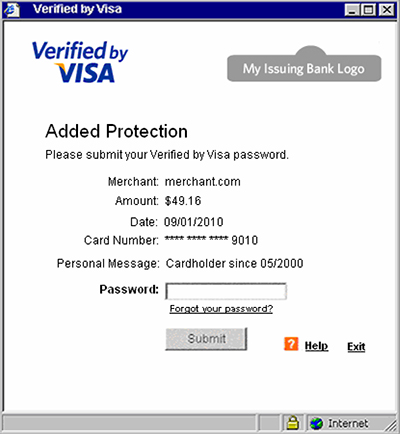

As soon as that’s finished, the cardholder’s 3-D Safe registration is full and he or she is taken again to the service provider’s checkout web page to finish the acquisition. From that time on, each time the cardholder makes use of that card at a service provider taking part with the relevant 3-D Safe service, she can be requested to enter her password at checkout. The authentication kind would look one thing like this for Visa:

Upon validation of the cardholder, the authentication window would disappear and the transaction authorization would full as ordinary.

Issues You Ought to Know

Your processor would make it easier to with the VbV implementation course of, so there isn’t a want for me to jot down about it right here. However I’ll say a number of phrases about the best way to arrange and use the Digital Commerce Indicator (ECI), which isn’t all the time finished accurately.

The ECI signifies the extent of safety used at checkout when the cardholder offered her cost info. It needs to be set to a worth equivalent to the authentication outcomes and the traits of the service provider checkout course of, as follows:

- ECI 5 — the cardholder was authenticated by the issuer, which verified the cardholder’s password or identification info.

- ECI 6 — the service provider tried to authenticate the cardholder, however both the cardholder or issuer was not taking part.

- ECI 7 — the transaction was processed over a safe channel (for instance, SSL / TLS), however cost authentication was not carried out, or the issuer responded that authentication couldn’t be carried out.

Nevertheless, U.S. retailers that are being monitored for extreme chargebacks or fraud will not be allowed to submit authenticated (ECI 5) and / or tried authentication (ECI 6) transactions.

Along with decreasing fraud, for authenticated transactions, 3-D Safe companies defend you from sure kinds of chargeback. For instance, for Verified by Visa, as issuers authenticate their cardholders’ identities throughout transactions, the next chargeback motive codes wouldn’t apply to efficiently authenticated transactions:

Moreover, if you happen to tried to authenticate a cardholder and both the issuer or cardholder was not taking part in Verified by Visa, you’ll nonetheless be protected against the above chargebacks for authenticated transactions.

That’s, you’ll be protected, if you happen to proceeded with the transaction, regardless of the shortage of cardholder or (extra hardly ever) issuer participation. In apply, the purpose of utilizing a 3-D Safe service provider account is to course of solely efficiently authenticated transactions.

The Takeaway

The advantages of utilizing a 3-D Safe service provider account are apparent. Nevertheless, so is the draw back. As you’ll be able to see from the outline of the 3-D verification course of, a cardholder’s participation includes going by way of a full-blown registration course of, which the cardholder must repeat for every particular person bank card. On the service provider aspect, at checkout, every further step reduces the conversion price, i.e. reduces gross sales. As already famous, analysis reveals that 3-D service provider accounts could be failing to finalize as much as 30 p.c of gross sales.

So, whether or not or not 3-D Safe ought to be used would rely in your circumstances. You probably have an enormous downside with fraud-related chargebacks, then 3-D is certainly an excellent choice to cope with the difficulty. For everybody else, nevertheless, an everyday high-risk service provider account would almost definitely be the higher alternative.

Picture credit score: YouTube / Visa.