The cost card business devotes important quantities of time and assets to growing authorization techniques and resolution fashions in an effort to mitigate the monetary losses. Each transaction begins and ends with the cardholder. Between the time the cardholder presents the cardboard for cost and receives the products or providers, nevertheless, quite a lot of information is exchanged, analyzed and processed. A course of that actually takes seconds on the level of sale is definitely a extremely advanced strategy to analyzing every transaction.

The authorization course of begins when the service provider supplies an authorization request to your Service provider Providers Supplier. After requesting authorization, the service provider receives an Authorization response, which she makes use of, partially, to find out whether or not to proceed with the transaction.

The aim of an authorization is to supply the service provider with data that may assist her decide whether or not or to not proceed with a transaction.

For each transaction, the service provider is required to acquire an authorization approval from American Specific for the total quantity of the cost aside from retailers which might be categorized within the restaurant, lodging and car rental industries.

An AmEx authorization approval doesn’t assure that:

- The individual making the cost is the cardholder.

- The transaction is actually legitimate or bona fide.

- The service provider will probably be paid for the transaction.

- The service provider is not going to be topic to a chargeback.

Potential Authorization Responses

Responses to requests for authorization are generated by the cardboard issuers and transmitted to the service provider. The next are among the many mostly generated responses to a request for authorization. The precise wording might differ, so test along with your Service provider Providers Supplier to find out what authorization responses will show in your tools.

| Authorization Response | What It Means |

| Authorised | The transaction is authorised. |

| Partially Authorised

(to be used with Pay as you go Playing cards solely) |

The transaction is authorised. The approval is for an quantity lower than the worth initially requested. The transaction should solely be submitted for the authorised quantity. Acquire the remaining funds due from the cardholder by way of one other type of cost. |

| Declined or Card Not Accepted | The transaction isn’t authorised. Don’t submit the transaction. In the event you however select to submit the Cost, you can be topic to a chargeback. Inform the cardholder promptly that the cardboard has been declined. If the cardholder has questions or considerations, advise her to name the customer support phone quantity on the again of the cardboard. By no means talk about the explanation for the decline. |

| Please Name or Referral | Extra data is required to finish the transaction. Name your Service provider Providers Supplier for help to finish the transaction. |

| Decide up | You might obtain an issuer level of sale response indicating that you have to decide up the Card. Observe your inner insurance policies if you obtain this response. By no means put your self or your workers in unsafe conditions. Contact your Service provider Providers Supplier for additional data concerning a Decide Up Card response. |

Acquiring an Digital Authorization

Usually, retailers should acquire an digital authorization. You could be certain that all authorization requests adjust to American Specific’ technical specs. If the authorization request doesn’t adjust to the technical specs, the submission could also be rejected or chances are you’ll be topic to a chargeback. Contact your Service provider Providers Supplier for details about your obligations to adjust to the technical specs.

If the cardboard is unreadable and it’s important to key-enter the transaction to acquire an authorization, then you have to comply with the necessities for key-entered transactions.

In the event you use an digital point-of-sale (POS) system to acquire authorization, the approval should be printed robotically on the cost report.

Often, acquiring an digital authorization is probably not attainable (e.g., because of POS system issues, system outages or different disruptions of an digital charge0. In these situations, you have to acquire a voice authorization.

Acquiring a Voice Authorization

When authorization is required, in case your digital POS system is unable to achieve American Specific’ authorization system, otherwise you would not have an digital POS system, you have to search authorization utilizing the next steps:

- Name your Service provider Providers Supplier’s authorization division.

- The next minimal data will probably be requested:

-

- Card Quantity.

- Service provider Quantity.

- Cost quantity.

Be aware: In some conditions, chances are you’ll be requested for extra data equivalent to Expiration Date or CID Quantity.

-

- A response will probably be supplied. If the request for authorization is authorised, seize the approval for submission.

- In case you are submitting electronically, you have to enter the approval into your POS system. For directions on full this sort of transaction, discuss with your Service provider Providers Supplier’s working directions or contact them instantly.

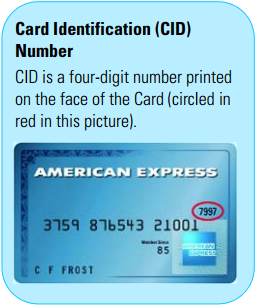

Card Identification (CID) Quantity

The Card Identification (CID) Quantity supplies an additional degree of cardholder validation and is a part of the authorization course of. The CID Quantity is printed on the American Specific card.

The Card Identification (CID) Quantity supplies an additional degree of cardholder validation and is a part of the authorization course of. The CID Quantity is printed on the American Specific card.

If, in the course of the authorization, a response is obtained that signifies the CID Quantity given by the individual trying the transaction doesn’t match the CID Quantity that’s printed on the cardboard, re-prompt the shopper a minimum of another time for the CID Quantity. If it fails to match once more, comply with your inner insurance policies.

Be aware: CID Numbers should not be saved for any goal. They’re out there for actual time transactions solely.

Authorization Reversal

It’s a good apply to reverse an American Specific authorization for an authorised transaction if you don’t intend to ship a submission to your Service provider Providers Supplier inside the authorization cut-off dates. You might reverse an authorization for a corresponding transaction by:

- Initiating an authorization reversal message, or

- Contacting your Service provider Providers Supplier for directions on reverse an authorization.

After a Cost Document has been submitted, nevertheless, the authorization can’t be canceled or modified. For instance, for those who make an error in a transaction however have already submitted the Cost Document, you can’t systematically request a change within the transaction. You could as an alternative, comply with the procedures for processing a credit score.

Authorization Time Restrict

Authorization approvals are legitimate for seven (7) days after the authorization date, aside from sure transactions from retailers which might be categorized within the lodging and car rental industries. You could acquire a brand new approval for those who submit the transaction to your Service provider Providers Supplier greater than seven (7) days after the unique authorization date.

For transactions of products or providers which might be shipped or supplied greater than seven (7) days after an order is positioned, you have to acquire an approval for the transaction on the time the order is positioned and once more on the time you ship or present the products or providers to the cardholder.

The brand new approval should be included within the Cost Document. If both of the authorization requests is declined, don’t present the products or providers or submit the transaction. In the event you do, you can be topic to a chargeback.

Flooring Restrict

You could acquire an authorization on all purchases, whatever the quantity, as a zero-dollar Flooring Restrict applies for all American Specific costs.

Pre-Authorization

A pre-authorization is an authorization request that you simply submit upfront of offering the products or providers, permitting you then to submit the Authorised Cost (e.g., gas pump CATs).

Extra Authorization Necessities

There are situations, that are outlined within the following desk, when further authorization necessities apply.

Retailers categorized in sure industries are additionally topic to further particular authorization necessities.

| Subject | Extra Necessities |

| Recurring Billing | You could flag all requests for authorization with a Recurring Billing indicator. To enhance the chance of acquiring an approval to an authorization request, it is strongly recommended that you simply periodically confirm with cardholders that each one their data (e.g., Card Quantity, Expiration Date, and billing deal with) remains to be correct. |

| American Specific Present Cheques and

American Specific Vacationers Cheques |

You aren’t required to acquire Authorization previous to accepting Present and Vacationers Cheques. You could, nevertheless, comply with the suitable procedures outlined. Questions in regards to the validity of Present or Vacationers Cheques may be addressed by calling the Vacationers Cheque / Present Cheque Buyer Service at 1-866-296-5198. |

| Break up Tender | Throughout a Break up Tender Transaction, the cardholder makes use of a number of types of cost for a single buy (e.g., pay as you go playing cards, money, card). You might comply with your coverage on combining cost on pay as you go playing cards with another cost merchandise or strategies of cost. If the opposite cost technique is a bank card, then you’re required to comply with all provisions of the settlement. Examine along with your Service provider Providers Supplier to find out in case your POS system is about up for Break up Tender performance. |

As cost can’t happen till the transactions are submitted, you’re inspired to submit transactions each day, or extra steadily, to your Service provider Providers Supplier, regardless that you’ve got as much as seven (7) days to take action.

Acquire transactions in the course of the enterprise day and submit them based on the directions supplied by your Service provider Providers Supplier.

You could submit transactions electronically besides below extraordinary circumstances. Whenever you transmit Cost Information and Transmission Information electronically, you have to nonetheless full and retain Cost Information and Credit score Information.

Cost Submissions

You could submit all costs to your Service provider Providers Supplier inside seven (7) days of the date they’re incurred. Expenses are deemed “incurred” on the date the cardholder signifies to you that they are going to pay for the products or providers bought with the cardboard.

Expenses should not be submitted to your Service provider Providers Supplier till after the products are shipped, supplied or the providers are rendered. You could submit all costs below the institution the place the cost originated.

For aggregated costs, the cost should be submitted inside seven (7) days of the date of the final buy (and / or refund as relevant) that includes the Aggregated Cost. Delayed Supply Expenses and Advance Cost Expenses could also be submitted earlier than the products are shipped, supplied or the providers are rendered.

Credit score Submissions

You could submit all credit to Service provider Providers Supplier inside seven (7) days of figuring out {that a} credit score is due. You could submit every credit score below the institution the place the credit score originated.

Submission Necessities — Paper

If, below extraordinary circumstances, you submit transactions on paper, you have to achieve this in accordance with directions supplied by your Service provider Providers Supplier.

Examples of circumstances which will stop retailers from submitting electronically are:

- Particular occasions (e.g., conferences, outside marketplaces, live shows),

- Retailers that don’t conduct enterprise from fastened areas,

- Distant areas or retailers who expertise system outages.

In the event you submit costs on paper, you have to create a Cost Document containing the entire following required information:

- Full Card Quantity and Expiration Date (pursuant to Relevant Regulation) and, if out there, cardholder title.

- The date the cost was incurred.

- The Authorization Approval.

- A transparent description of the products or providers bought by the cardholder.

- An imprint or different descriptor of your title, deal with, Service provider Quantity and, if relevant, retailer quantity.

- The phrases “No Refunds” you probably have a no refund coverage, and your return and / or cancellation insurance policies.

- If a Card Current Cost, the cardholder’s signature.

- If a Card Not Current Cost, the phrases “phone order”, “mail order”, “Web Order”, or “signature on file”, as relevant.

Cost Information submitted on paper should adjust to the relevant necessities. Expenses should be submitted in accordance with the relevant necessities. Discuss with your Service provider Providers Supplier’s directions when submitting Transactions on paper.

The best way to Submit

In lots of circumstances, your POS system robotically processes the transactions in batches on the finish of the day. On busy days, your transaction quantity could also be better than your POS system’s storage functionality.

Seek the advice of data supplied by your Service provider Providers Supplier to find out POS storage capability and whether or not it’s essential to submit a number of batches (e.g., submit a batch at noon and once more within the night).

Contact your Service provider Providers Supplier for extra data concerning submission necessities.

Picture supply: Wikimedia.